Charitable Remainder Trust: How It Works and Why It Matters

When you set up a charitable remainder trust, a legal arrangement where you transfer assets to a trust that pays you income for life, then gives the rest to charity. It’s not just a way to give—it’s a way to plan, protect, and leave something lasting. Unlike writing a check, this tool lets you keep income flowing to you or your family while still supporting the causes you care about. It’s used by people who own property, stocks, or other assets they want to turn into long-term giving without losing financial security.

Related to this are charitable trusts, legal structures that hold assets for nonprofit purposes, and legacy giving, planned donations that outlive the donor. A charitable remainder trust is one specific type of charitable trust, designed to pay you first, then pass the remainder to charity. It’s different from a simple donation because it’s structured, tax-smart, and flexible. You can choose how long the payments last—your lifetime, your spouse’s, or even a set number of years. And because the trust is tax-exempt, you often get an immediate tax deduction based on the value of what will eventually go to charity.

This isn’t just for the wealthy. People with homes, retirement accounts, or even small investment portfolios use these trusts to reduce capital gains taxes, avoid selling assets at a loss, and make sure their giving has maximum impact. It’s also tied to nonprofit giving, how individuals and families support organizations over time. Many charities rely on these long-term gifts to fund programs for years. And while you’re alive, you can still feel the difference—knowing your gift will keep helping, even after you’re gone.

What you’ll find below are real stories and practical guides on how people use this tool, what happens after they set it up, and how it connects to the bigger picture of giving back. From how it affects your taxes to how it changes the way nonprofits plan their future, these posts break down the myths and show you what actually works. Whether you’re thinking about your own legacy or just curious how big donations get made, you’ll find clear, no-fluff answers here.

6 January 2026

Elara Greenwood

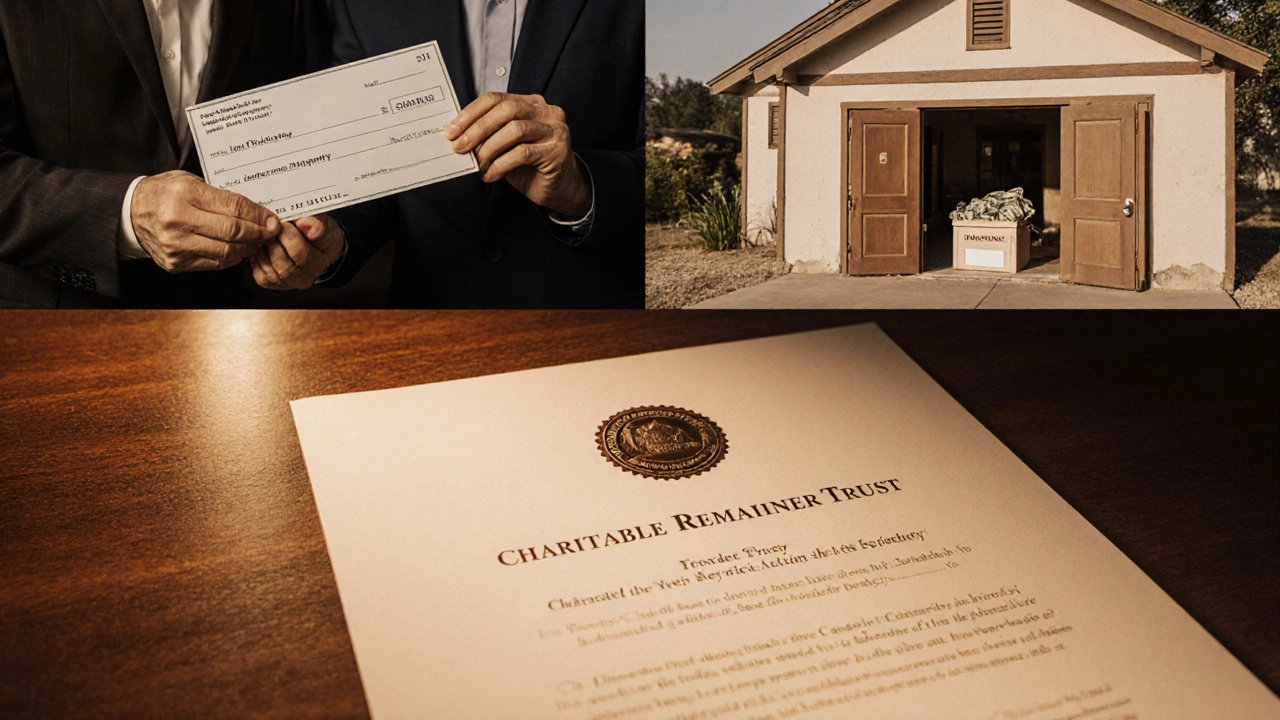

A charitable remainder trust lets you give to charity while keeping income for yourself. It avoids capital gains tax, offers big tax deductions, and helps reduce estate taxes-making it a smart tool for donors with appreciated assets.

Continue Reading...

24 October 2025

Elara Greenwood

Explore the main drawbacks of a Charitable Remainder Trust, from irrevocability and costs to tax and income risks, and learn how to mitigate them.

Continue Reading...

9 October 2025

Elara Greenwood

Learn if and how you can place a house into a charitable remainder trust, the tax benefits, step‑by‑step process, pitfalls, and alternatives for real‑estate donors.

Continue Reading...

17 March 2025

Elara Greenwood

Ever wondered what happens if a charitable remainder trust runs out of money? This article dives into the core mechanics of these trusts and what may unfold when funds deplete. You'll learn why monitoring the trust's financial health is key and explore practical tips for proactive management. Understand how these trusts could impact both donors and beneficiaries when the unexpected happens.

Continue Reading...