Charity Organizations: How They Work, Who Runs Them, and Where Your Money Goes

When you think of charity organizations, nonprofit groups dedicated to helping people, animals, or causes without seeking profit. Also known as nonprofits, they rely on donations, grants, and volunteers to keep their work going. But not all charities are the same. Some are simple local food banks. Others are complex legal structures like charitable trusts, legal arrangements that hold assets to support a cause over time, often with tax advantages for donors. And then there’s the charitable remainder trust, a specific type of trust that pays income to a donor or beneficiary first, then gives the rest to charity. These aren’t just buzzwords—they’re tools people use to give smarter, longer, and with more control.

Ever wonder who can actually run a charity? It’s not just rich folks with lawyers. Anyone with a clear mission, basic paperwork, and a plan can start one. But running it well? That’s where things get real. You need transparency, accountability, and a solid understanding of how money flows. Too many people assume every dollar donated goes straight to the cause. But in reality, charities have to pay staff, rent, software, and legal fees just to stay open. That’s why knowing how charity fund distribution, how donated money is split between programs and overhead works matters. It’s not about avoiding all costs—it’s about spotting organizations that spend wisely. And if you’re thinking about giving big, like a house or investments, a charitable remainder trust, a trust that pays you income now and leaves the rest to charity later might be the move. But it’s not for everyone. There are costs, rules, and risks—like what happens if the trust runs out of money before the charity gets its share.

So what’s in this collection? You’ll find clear breakdowns of how charitable trusts actually work, what their biggest downsides are, and how real people use them to give their homes or savings to causes they care about. You’ll see how to pick a charity that actually delivers impact—not just one with a fancy logo. You’ll learn what percentage of your donation typically goes to the cause, and why some charities rank higher than others. And if you’ve ever thought about starting your own charity fund, you’ll get the no-fluff steps to make it legal and sustainable. This isn’t theory. It’s what works, what doesn’t, and what you need to know before you write a check or sign a paper.

6 February 2026

Elara Greenwood

Clarifying the misconception around 'rare mental health charity' and highlighting lesser-known organizations that support specific mental health conditions. Learn how to find and support these vital resources.

Continue Reading...

6 January 2026

Elara Greenwood

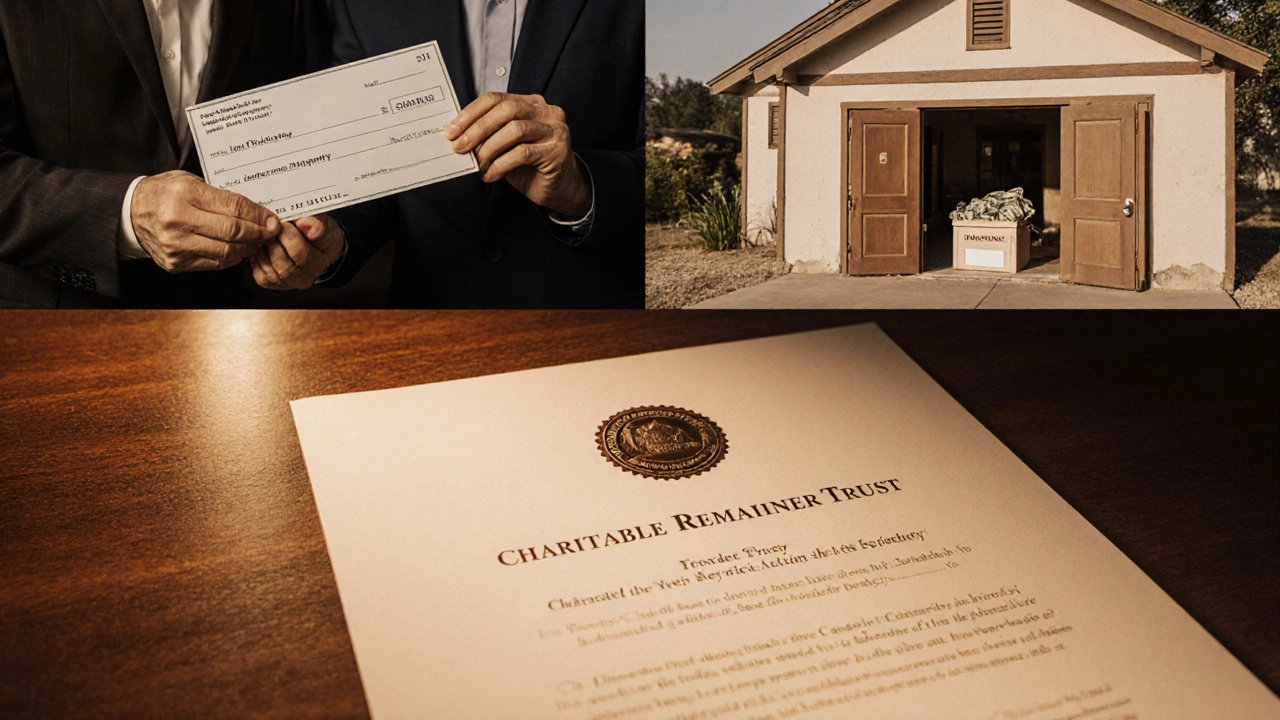

A charitable remainder trust lets you give to charity while keeping income for yourself. It avoids capital gains tax, offers big tax deductions, and helps reduce estate taxes-making it a smart tool for donors with appreciated assets.

Continue Reading...

8 November 2025

Elara Greenwood

A charitable trust lets you give assets to support a cause while controlling how the money is used. It offers tax benefits, long-term impact, and flexibility for donors who want to leave a lasting legacy.

Continue Reading...

24 October 2025

Elara Greenwood

Explore the main drawbacks of a Charitable Remainder Trust, from irrevocability and costs to tax and income risks, and learn how to mitigate them.

Continue Reading...

9 October 2025

Elara Greenwood

Learn if and how you can place a house into a charitable remainder trust, the tax benefits, step‑by‑step process, pitfalls, and alternatives for real‑estate donors.

Continue Reading...

1 October 2025

Elara Greenwood

Find out how to choose the best charity to support in 2025 with clear criteria, top-rated charities, and a step‑by‑step giving guide.

Continue Reading...

17 September 2025

Elara Greenwood

Quick answer plus context: who tops donations now, how “popular” is measured, and a simple checklist to choose a credible charity with real impact.

Continue Reading...

4 August 2025

Elara Greenwood

Unpack the real differences between charities and charitable trusts, from daily operations to tax perks, with tips and clear examples anyone can understand.

Continue Reading...

28 July 2025

Elara Greenwood

Ever wondered who can run a charity? Find out exactly who’s eligible, real-life tips, and advice for starting your own successful nonprofit.

Continue Reading...

19 June 2025

Elara Greenwood

Thinking about making a real difference? Setting up a charity fund might be easier than you think. This guide breaks down every step, from getting your idea organized to making sure you’re legal and ready for donations. Expect practical tips, must-know facts, and real talk about mistakes to avoid. Perfect for anyone dreaming of giving back—even if you’ve never done it before.

Continue Reading...

29 May 2025

Elara Greenwood

Curious about charitable trusts? This article breaks down what makes them tick—their perks, their pitfalls, and what you should watch out for before diving in. You'll get real-life examples and practical tips that can help you decide if a charitable trust is right for you or your organization. From tax benefits to the red tape, we keep things clear and grounded. Perfect for anyone who wants the inside scoop before making a move.

Continue Reading...

17 March 2025

Elara Greenwood

Ever wondered what happens if a charitable remainder trust runs out of money? This article dives into the core mechanics of these trusts and what may unfold when funds deplete. You'll learn why monitoring the trust's financial health is key and explore practical tips for proactive management. Understand how these trusts could impact both donors and beneficiaries when the unexpected happens.

Continue Reading...